FREE ONLINE BUDGET PLANNER HOW TO

Here are some Tips to help you understand exactly How to make a budget: It is a great way to save for goals or ensure that you stick to a specific financial plan in order to pay back your debts and improve your credit. However at the end of the month a lot of them end up broke or slightly in debt.Ī budget helps you control your resources and fulfill specific goals in the process. Most people deal with steady sources of monthly or weekly income in the form of salaries, commissions, stipends or even allowances. How to make a BudgetBudgeting is a crucial part of financial planning. Or they may incorporate them all into a Monthly budget plan or an Annual budget plan. It allows you create your own worksheets with subcategories to organize different sources of income and expenditure.īudget Planners are versatile tools which can help calculate various kinds of budgets according to your needs like:

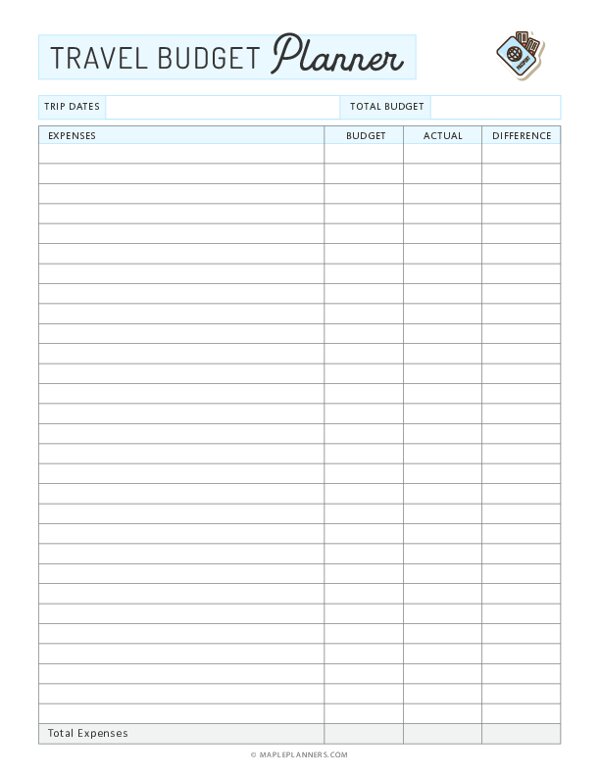

What is a Budget Planner?A Budget planner is an inclusive calculation tool that keeps tabs on your budget and helps to optimize your available resources. The objective of the budget is to meet the set targets without exceeding the stipulated financial limits.

Not only does it plan expenses around potential income, a business budget is a strategy that sets targets and objectives within the time period. It includes multiple variables like projected sales volumes, available resources, costs, assets, liabilities and cash influx. It is a crucial counter measure against excessive spending, miscalculations and risk.Ī Budget is defined as a quantifiable rendition of a financial plan for a specifically demarcated period of time.įor domestic purposes a budget is limited to laying out and preparing for potential expenditure in keeping with potential earnings without compromising a basic standard of living that should ideally improve with time.Ī budget for business purposes is slightly more complex. It is an essential aspect of financial planning for both business and domestic purposes.

FREE ONLINE BUDGET PLANNER PROFESSIONAL

For this reason, you should consider the appropriateness for the information to your own circumstances and, if necessary, seek appropriate professional advice.What is a Budget?A budget is a basic financial strategy outlining potential expenditure and income over a specific period of time. This information is general in nature and has been prepared without taking your objectives, needs and overall financial situation into account. You should obtain professional financial advice before making any financial decision. Should you apply for any St.George Bank product, we will make our own calculations and we will not necessarily take the results of your calculations using this Calculator into account. It is intended for use by you as a guide only, and not intended to be relied on for the purposes of making a decision in relation to a financial product. The calculator is generic and does not take into account your personal circumstances. The assumptions may not reflect the ways in which our Bank's computer systems work. This calculator model contains a number of assumptions and they are set out in the i button. Consider its appropriateness to these factors before acting on it. This information does not take your personal objectives, circumstances or needs into account.

0 kommentar(er)

0 kommentar(er)